The Retail Model Is Broken. Your Growth Doesn't Have to Be.

We help ambitious consumer brands turn data overload into growth clarity — so you can scale what actually works, not what you think might.

Book Your Free Discovery Call

You're Not Stuck. You're Drowning in Noise.

You're scaling. You have data. You're in major retailers or pushing hard to get there.

But here's what's actually happening:

Your retail buyers are shortening cycles and holding back OTB. Your production calendar doesn't match their buying windows. Digital growth at retailers, on DTC, and across 3P marketplaces is tedious, labor-intensive, and expensive. The economics of driving clicks are fundamentally different than what works in brick-and-mortar — and the tools, tactics, and complexity keep multiplying. You're drowning in metrics but can't tell what's insight and what's noise.

You're growing — but it's getting harder, slower, and more expensive. And you can feel it: the growth model that worked three years ago doesn't work anymore.

The brands that win the next cycle won't be the ones with more data. They'll be the ones who can detect the signal, decode what it means, and deploy faster than everyone else.

That's where we come in.

Built for Brands Ready to Scale Intelligently

Signal & Scale Insights works with four types of clients — all ambitious, all data-driven, all looking for commercial clarity.

Scaling National Brands

$50M–$500M+ Revenue

Already selling through major national retailers (Walmart, Target, Amazon, specialty chains) and online marketplaces. Need sharper clarity on what's driving velocity vs. what's dragging margin. Looking to grow across retail, digital, and DTC without guessing.

Emerging Challenger Brands

$10M–$100M Revenue

In aggressive retail expansion mode. Want the systems and strategy of a mature brand without the bureaucracy. Need retail fluency and growth confidence fast.

Private Equity & Operators

Portfolio Management

Portfolio managers or operating partners managing multiple consumer brands. Need rapid diagnostics to inform investment or turnaround decisions. Want a commercial x-ray before deploying capital.

Talent & Licensing Partners

Celebrity & IP Brands

Representing talent, IP, or celebrity brands looking to build retail activations, collaborations, or DTR opportunities. Need to structure deals that drive actual performance, not just PR. Want to prove to retailers that your talent brings new customers and velocity.

If you're decisive, data-driven, and ready to move — we're built for you.

We Don't Teach Retail. We Translate It.

Most consultants analyze retail from the outside looking in.

We've led it from the inside.

We've built, scaled, and led billion-dollar brands at the world's largest retailers — making the decisions that shape how retail moves. That means we don't speculate about what retailers want. We understand the patterns that drive their decisions.

We see the signals behind the noise. The timing shifts. The buyer psychology. The category dynamics that determine placement, pricing, and performance.

This isn't consulting. It's commercial pattern intelligence.

And it's the difference between guessing what might work — and knowing what will.

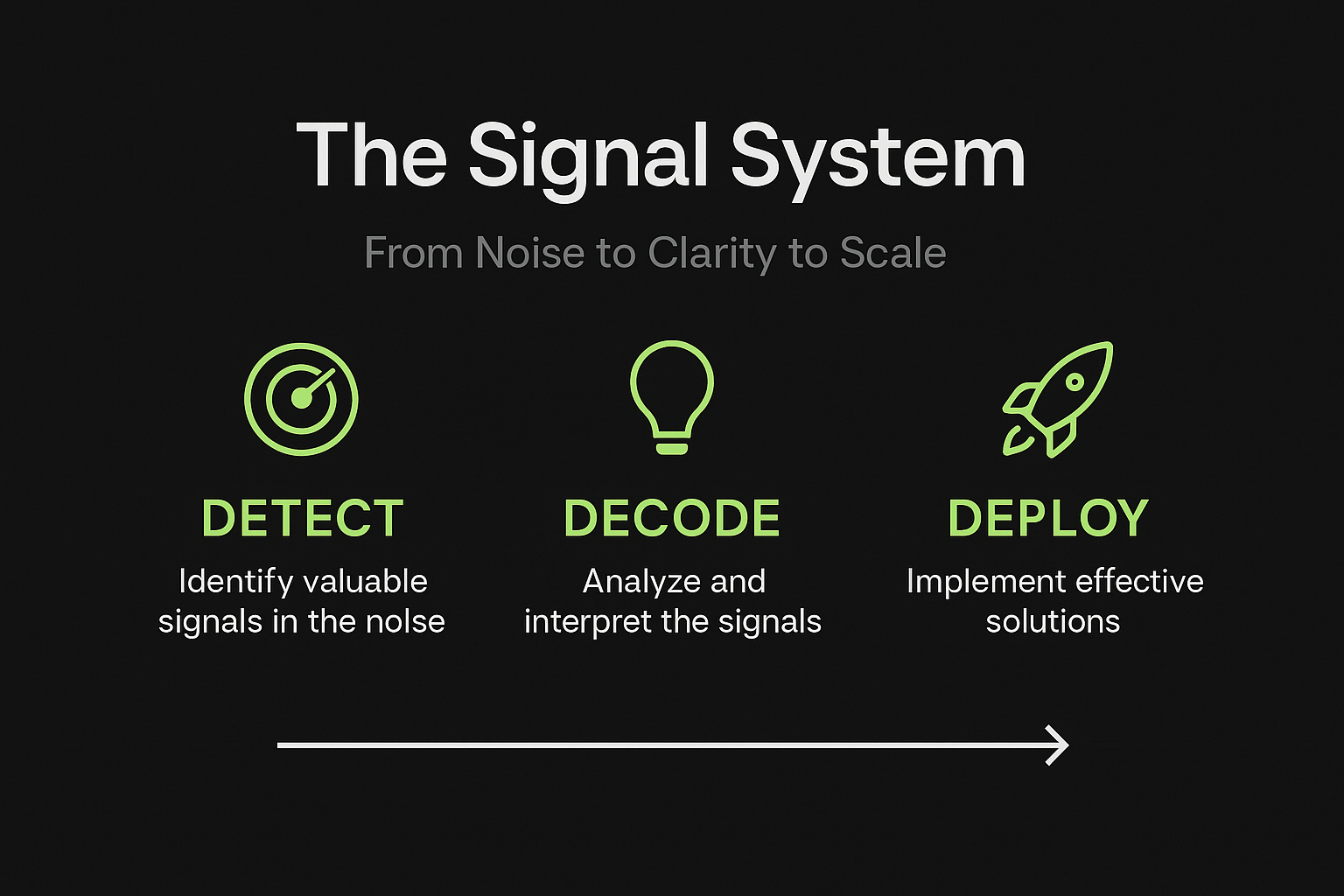

Our Framework: The Signal System™

How brands move from noise → clarity → scale.

This isn't theory. It's a proven system built on decades of firsthand retail experience and designed for the market we're in now — volatile, fragmented, and unforgiving of guesswork.

Start With a Signal Scan™

A two-week strategic diagnostic that reveals where your next 10–20% growth will come from — and what's quietly killing your margin.

In two weeks, we give you what most brands spend six months trying to figure out:

- What's actually driving your velocity (and what's just noise)

- Where retail timing and production calendars are misaligned

- Which channels, SKUs, or strategies are worth doubling down on

- The three highest-leverage actions you can take this quarter

No six-month audits. No generic playbooks. Just clarity, backed by 25 years of retail leadership and advanced analytical tools.

Email: jillian@signalandscaleinsights.com

Phone: +1 (479) 995-9309

The Market Is Reorganizing. Clarity Is No Longer Optional.

The retail landscape has fundamentally shifted. Six forces are rewriting the rules:

1. Calendar Chaos

Retail buying cycles no longer match production calendars. Buyers chase in-season wins. Suppliers miss delivery windows. The gap between planning and reality is costing brands millions in lost margin.

2. Shelf Space Compression

Retailers are collapsing. Assortments are shrinking. If you're not signaling clear performance, you're being deprioritized.

3. Data Overload

Every platform drowns you in metrics. Leaders can't tell what's insight and what's distraction.

4. Channel Fragmentation

Omnichannel has become omni-chaos. DTC, marketplace, retail, wholesale — all pulling in different directions with no unified growth system.

5. Economic Reality

Demand volatility and economic uncertainty mean efficiency and foresight matter more than expansion. Brands that scale noise will burn resources. Brands that scale signal will win.

6. Margin Pressure

Rising costs, compressed margins, and pricing pressure from retailers mean every decision matters. You can't afford to guess. You need clarity on what drives profitability and what quietly kills it.

The cost of waiting now exceeds the cost of alignment. Every quarter without signal clarity is a quarter spent optimizing the wrong levers.

Retail Strategy Services

Strategic consulting for consumer brands scaling through major retailers

Retail Expansion Strategy

Entry strategy for Walmart, Target, Amazon, and specialty retailers. We help you navigate buyer relationships, product positioning, and launch timing.

Merchandising & Assortment Optimization

Strategic guidance on SKU rationalization, product mix, pricing architecture, and margin improvement based on 25 years of buying and merchandising leadership.

Omnichannel Strategy

Unified growth strategy across DTC, wholesale, marketplace, and retail channels. End the chaos. Build a system that works.

Private Equity Due Diligence

Rapid commercial diagnostics for PE firms evaluating consumer brand acquisitions or portfolio optimization. Get an insider's view before you deploy capital.

Celebrity, Influencer & Designer Collaborations

End-to-end Direct-to-Retail (DTR) brand development and IP commercialization. From deal structure to product development, marketing strategy, PR integration, and omnichannel retail launch. We've built these partnerships from the retailer side and know what actually drives performance vs. what just generates headlines.

Fractional CMO & Strategic Advisory

Ongoing strategic partnership for brands that need senior-level retail and brand strategy without full-time executive overhead.

Frequently Asked Questions

What is retail strategy consulting?

Retail strategy consulting helps consumer brands optimize their retail performance across traditional retail, DTC, and marketplace channels. At Signal & Scale Insights, we provide diagnostic services that identify growth opportunities and operational inefficiencies in 2 weeks.

How long does a Signal Scan take?

A Signal Scan is a two-week strategic diagnostic. Week 1 focuses on detection (research, assessment, analysis). Week 2 focuses on decoding (insights, recommendations, planning). You receive actionable recommendations within 14 days.

Who is Jillian Cueff?

Jillian Cueff is the founder of Signal & Scale Insights and a retail strategist with 25 years of experience building and scaling billion-dollar brands at the world's largest retailers. She specializes in translating retail buyer psychology and market signals into actionable growth strategies for consumer brands.

What types of brands benefit from Signal & Scale Insights?

We work with four types of clients: (1) Scaling National Brands already in major retail, (2) Emerging Challenger Brands ($10M-$100M revenue), (3) Private Equity & Operators managing consumer brand portfolios, and (4) Talent & Licensing Partners building retail activations for celebrity brands.

What is the Signal System?

The Signal System is our proprietary framework for moving brands from noise to clarity to scale. It consists of three phases: DETECT (identify market signals and growth opportunities), DECODE (translate data into strategic insights), and DEPLOY (execute high-leverage actions for measurable growth).

How is Signal & Scale different from other retail consultants?

Unlike traditional consultants who analyze retail from the outside, we've led retail decisions from the inside. Our founder spent 25 years making the buying, merchandising, and strategy decisions that shape how retail moves. We provide commercial pattern intelligence, not theoretical recommendations.

What deliverables do you provide in a Signal Scan?

A Signal Scan delivers four key outputs: (1) Analysis of what's driving velocity vs. dragging margin, (2) Identification of retail timing and production calendar misalignments, (3) Recommendations on which channels, SKUs, or strategies to prioritize, and (4) Three highest-leverage actions to take this quarter.

Why is retail strategy important for consumer brands right now?

The retail landscape has fundamentally shifted due to five forces: calendar chaos (buying cycles misaligned with production), shelf space compression (retailers consolidating), data overload (metrics without insights), channel fragmentation (omnichannel complexity), and economic reality (margin pressure). Brands that can't detect and decode these signals will fall behind.

Built by One of Retail's Most Accomplished Strategists

Founded by Jillian Cueff — a 25-year retail and merchandising executive who led billion-dollar brand portfolios at America's largest national retailers.

Featured in: Retail Women in Tech's "Power of WE" series

What Makes This Different:

25 years building billion-dollar brands from the inside — not analyzing from conference rooms, but making the actual decisions that determine what gets shelf space, marketing support, and what gets cut when performance drops.

Led merchandising, buying, and P&L across retail's largest categories — apparel, accessories, jewelry — at major national retailers. Managed teams, vendor partnerships, and omnichannel strategy spanning brick-and-mortar, e-commerce, and emerging digital channels.

Built celebrity and designer collaborations that actually performed — DTR (Direct-to-Retail) partnerships structured to drive velocity and prove incrementality, not just generate headlines. Negotiated from both sides of the table.

University of Pennsylvania graduate. Industry speaker. Featured in Retail Women in Tech's "Power of WE" series.

The difference: Most consultants guess what retailers want. Jillian knows — because she was the retailer making those decisions.

Get Your Free Guide

"5 Signals Your Retail Strategy Is Broken" — A strategic diagnostic to identify what's quietly killing your growth and margin.